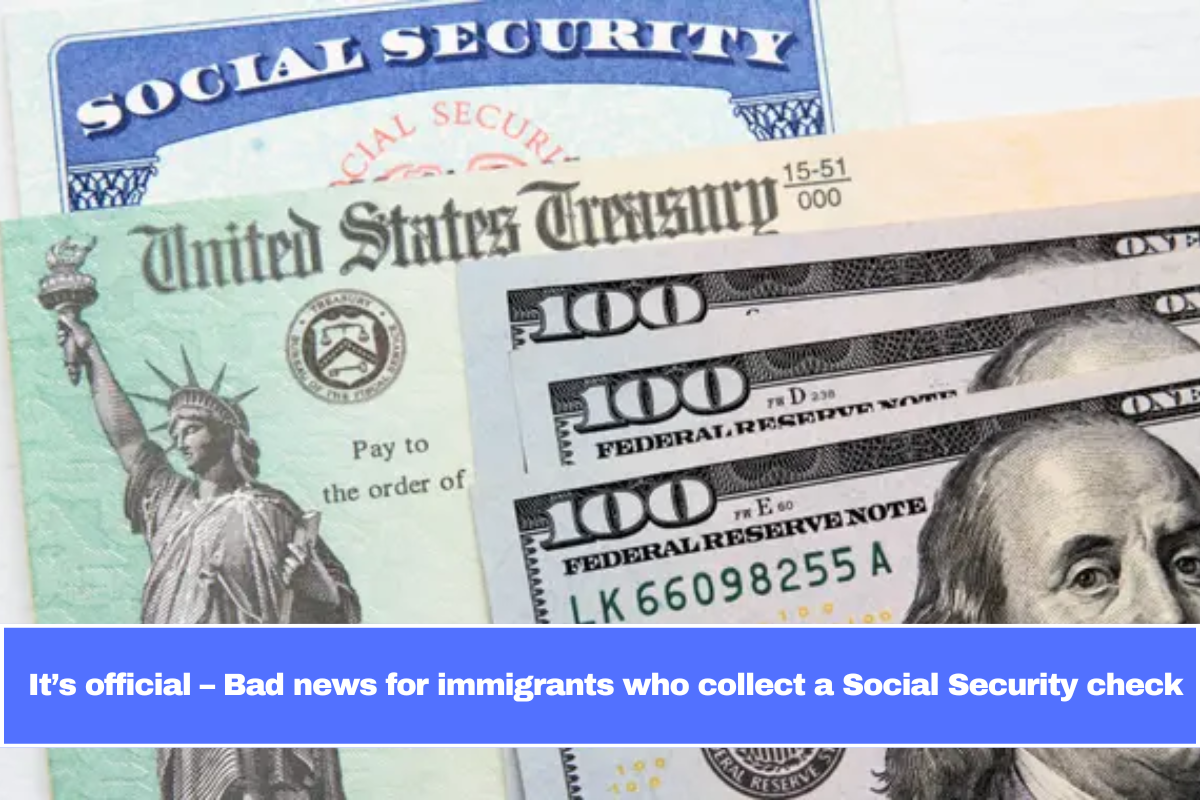

The retirement benefits provided by Social Security are about to undergo some modifications, and it is possible that some users will not be pleased with how these changes will effect them.

An abolition of the Windfall Elimination Provision (WEP), which would have an impact on a large number of retirees, is one of the measures that could be considered one of the most controversial.

According to the Social Security Administration (SSA), the Work Earnings Adjustment Program (WEP) is “a formula used to adjust Social Security worker benefits for people who receive “non-covered pensions” and qualify for Social Security benefits based on other earnings that are covered by Social Security.”

A pension that is paid by an employer that does not deduct Social Security taxes from your income is known as a non-covered pension. This type of pension is often paid by state and municipal governments or firms who are not based in the United States.

What this means is that the WEP is intended to equalize payments for beneficiaries who receive pensions without having contributed to the system with their taxes, so cutting payments for those who have not worked the required 35 full years in order to obtain the maximum retirement benefit.

Because it is generally accepted that the pension will compensate for the amount of money that a person ought to have gotten after working for their entire life, this is the reason why this is the case.

This can be detrimental to individuals who have worked in both the private and public sectors, as well as in jobs that are pensioned and jobs that are not pensioned, during the course of their lifetime.

This is because the benefits are sometimes decreased in situations where the individual has earned the credits and ought to be entitled to a greater Social Security payment.

Immigration is a group that is disproportionately affected by the WEP provision, immigrants, but there is one group in particular that is affected by it.

How the WEP affects the Social Security benefits of immigrants

The impact is the same and just as damaging regardless of whether you are an American citizen living and working abroad who returns home for retirement with a pension or if you are an American resident who has worked outside of the country in the past and now has both a domestic and a foreign right to benefits. Both scenarios are equally damaging.

With regard to the WEP, “U.S. citizens who have worked outside the United States, naturalized U.S. citizens who have worked in their country of birth, and legal immigrants all have their monthly Social Security pension significantly reduced because they receive a foreign pension,” as stated by the website change.org who spearheaded a petition which was the driving force behind a petition to have this provision repealed.

There is a possibility that their Social Security pension will be decreased by up to $557.50 per month beginning in 2023.

Individuals with lower incomes are disproportionately affected by the Worker’s Earnings Program (WEP), and a significant percentage of these individuals are receivers of foreign pensions, whose combined income is frequently at or near the poverty level.

As a result of this petition and the efforts of a large number of lawmakers (the bill to repeal WEP received a significant amount of support in the House of Representatives, including that of the Speaker of the House), this provision and another one that is typically used in conjunction with it, the Government Pension Offset (GPO), which “adjusts Social Security spousal or widow(er) benefits for people who receive “non-covered pensions,” have been struck down.

Representatives Abigail Spanberger, a Democrat from Virginia, and Garret Graves, a Republican from Louisiana, who are co-leaders of the bill, expressed their joy on the fact that this bill was ultimately enacted and that these outmoded elements were eliminated.

Graves stated that for the past four decades, there has been a pattern of discrimination against a particular group of workers and a different way of treating people. According to what he said, “They are not people who are overpaid, nor are they people who are underworked.”

On Tuesday, Spanberger appeared on the floor of the House of Representatives and stated that “the long-term solvency of Social Security is an issue that Congress must address.” She stated that “but that is a separate issue from allowing Americans who did their part, who contributed their earnings, for them to retire with dignity,” and that “but that is a separate issue!”

In spite of the fact that there is still a great deal of work to be done in order to guarantee that benefits are both sufficient and sufficient to pay the expenses of recipients, striking the WEP is a good first step to ensure that individuals who have worked get paid what they are entitled to.

Leave a Reply